Taking Custom Design to New Levels

PROUD TO BE PART OF THE BRIN FAMILY OF COMPANIES

OTHER BRIN LOCATIONS

Brin Glass Company | Minneapolis, MN

St. Germain’s Glass | Duluth, MN

Heartland Glass | Waite Park, MN

As the world continues to embrace technological advancements, the robotics stock sector is emerging as a significant area of interest for investors looking to capitalize on future growth potential. According to renowned robotics industry expert Dr. Emma Jacobs, "The rapid evolution of robotics technology is reshaping various industries, providing immense investment opportunities for those keen on robotics stocks." This sentiment underscores the importance of staying informed about key players in the market as advancements in artificial intelligence and automation propel the industry forward.

In recent years, robotics stocks have sparked considerable attention from investors, driven by an increasing demand for automation in sectors such as manufacturing, healthcare, and logistics. Companies involved in developing cutting-edge robotic solutions are not only positioned to boost efficiency and productivity but also present attractive investment opportunities. As Dr. Jacobs highlights, the intersection of robotics innovation and strategic investment has the potential to yield significant returns for forward-thinking investors.

With the ongoing evolution of robotics technology, understanding the dynamics of the robotics stock market is crucial for investors. By identifying promising companies that are at the forefront of this transformation, investors can strategically position themselves to benefit from the potential growth of the industry. As we delve deeper into the top robotics stocks to watch, it becomes evident that the future holds exciting prospects for those ready to embrace this rapidly advancing field.

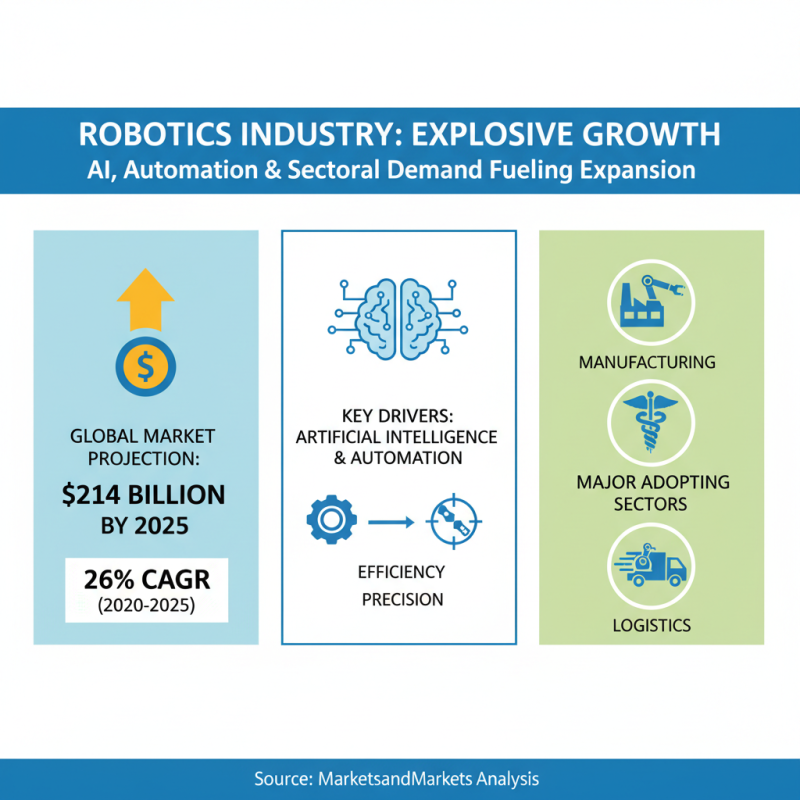

The robotics industry is experiencing unprecedented growth, driven by advancements in artificial intelligence, automation, and increased demand across various sectors. According to a recent market analysis by MarketsandMarkets, the global robotics market is projected to reach $214 billion by 2025, growing at a compound annual growth rate (CAGR) of 26%. This explosive growth is predominantly fueled by sectors such as manufacturing, healthcare, and logistics, which are increasingly adopting robotic systems to enhance efficiency and precision.

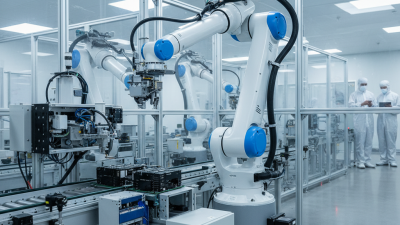

In 2023, key trends influencing the robotics sector include the rise of collaborative robots (cobots), which are designed to work alongside humans safely and effectively. A report from ResearchAndMarkets indicates that the cobot market is expected to witness significant growth, with a CAGR of over 30% in the coming years. Additionally, advancements in machine learning and computer vision are making robots smarter and more adaptable, allowing them to perform tasks that were previously thought to be exclusively human. As businesses continue to invest in automation technologies to optimize operations and reduce costs, the potential for growth within the robotics stock market is substantial, presenting compelling investment opportunities for stakeholders looking to capitalize on this rapidly evolving landscape.

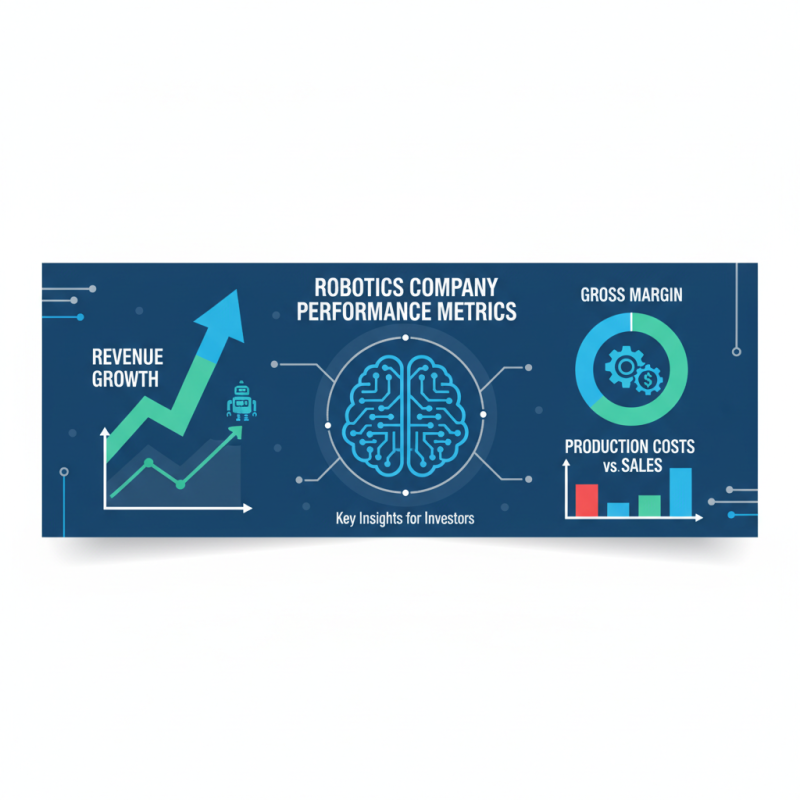

When assessing the performance of robotics companies, several key metrics can provide valuable insights for investors. One of the most critical metrics is revenue growth, which indicates a company's ability to expand its market share and innovate its product offerings. A consistent increase in revenue over multiple quarters signifies strong demand for their robotics solutions and suggests a favorable outlook for future profitability. Additionally, gross margin analysis can help determine how effectively a company is managing its production costs relative to its sales, shedding light on operational efficiency.

Another important metric is research and development (R&D) expenditure. A robust investment in R&D reflects a company's commitment to innovation and technological advancement, which are vital in the fast-evolving robotics field. Companies that aggressively allocate resources toward developing new technologies or enhancing existing products are more likely to maintain a competitive edge. Furthermore, evaluating the company's customer acquisition cost (CAC) and lifetime value (LTV) can provide insights into its marketing effectiveness and customer retention strategies, which are essential for sustaining growth in the long term. By analyzing these metrics, investors can gauge the robustness of a robotics company's business model and its potential for future success.

The robotics sector is poised for substantial growth, driven by emerging technologies that are transforming industries across the board. According to the International Federation of Robotics, the global market for robotics is projected to reach $214 billion by 2025, fueled by advancements in artificial intelligence, machine learning, and automation. These technologies are not only enhancing operational efficiencies but also creating opportunities for innovation in sectors like healthcare, manufacturing, and logistics.

As industries continue to adopt robotic solutions, key trends are emerging that highlight potential investment opportunities. For instance, the integration of collaborative robots, or cobots, into workplaces is revolutionizing task execution by allowing humans and robots to work side by side. A recent report from MarketsandMarkets indicates that the cobot market alone could exceed $7.5 billion by 2026, underscoring the significant demand for versatile automation solutions. Additionally, the rise of autonomous drones and delivery systems is further indicative of how robotics is reshaping logistics and distribution approaches, with experts projecting a CAGR of over 15% for this segment in the coming years.

Tips: For investors looking to capitalize on the robotics trend, it is essential to monitor how companies adapt to these emerging technologies and evaluate their long-term strategies focusing on sustainability and efficiency. Staying informed about industry reports and forecasts can provide valuable insights for making strategic investment decisions in the robotics landscape.

| Company Type | Market Capitalization (in Billion $) | Growth Rate (%) | Latest Investment ($ Million) | Headquarters Location |

|---|---|---|---|---|

| Industrial Robotics | 25 | 10 | 500 | USA |

| Service Robotics | 18 | 15 | 300 | Germany |

| Consumer Robotics | 12 | 8 | 200 | Japan |

| Healthcare Robotics | 15 | 12 | 450 | Switzerland |

| Autonomous Vehicles | 30 | 20 | 1000 | USA |

Investing in robotics stocks presents both exciting opportunities and notable risks that potential investors should carefully consider. As the robotics industry continues to expand due to advancements in technology, automation, and artificial intelligence, companies in this sector are increasingly positioned for growth. However, the inherent volatility in technology stocks, coupled with rapid innovation cycles, necessitates a cautious approach. Investors are encouraged to conduct thorough research on market trends, product pipelines, and the competitive landscape before diving into specific stocks.

Diversification is a key strategy for mitigating risk in robotics investments. By spreading investments across various segments of the robotics industry—such as manufacturing automation, healthcare robotics, and consumer robotics—investors can cushion their portfolios against sector-specific downturns. Additionally, keeping an eye on regulatory changes and technological disruptions is crucial, as these factors can significantly impact stock performance. Engaging with market analysts and leveraging industry reports can also provide valuable insights and aid in making informed decisions. Choosing a mix of established players and promising startups may strike a balance between stability and growth potential in this dynamic field.

The robotics industry is poised for remarkable growth by 2030, driven by advancements in artificial intelligence, automation, and machine learning. Projections indicate that the market will expand significantly, with increased applications across various sectors such as manufacturing, healthcare, logistics, and consumer services. As organizations strive for efficiency and cost reduction, the demand for robotic solutions is set to soar, resulting in innovative products that enhance productivity and safety.

Furthermore, the integration of robotics with emerging technologies such as the Internet of Things (IoT) and big data analytics is expected to fuel new opportunities for investment and development. By 2030, robots will not only perform repetitive tasks but will also analyze real-time data to make autonomous decisions, transforming the landscape of industries. This shift will likely create a myriad of job roles that focus on programming, maintaining, and improving these intelligent systems, thereby reshaping the workforce in a positive manner. As investors look to capitalize on this upward trajectory, the potential for growth in the robotics sector presents an enticing landscape for strategic investments and innovation.

Taking Custom Design to New Levels

Brin Glass Company | Minneapolis, MN

St. Germain’s Glass | Duluth, MN

Heartland Glass | Waite Park, MN

Fabricator

Inside Sales and Client Support Manager

Glass Handler – 1st Shift