Taking Custom Design to New Levels

PROUD TO BE PART OF THE BRIN FAMILY OF COMPANIES

OTHER BRIN LOCATIONS

Brin Glass Company | Minneapolis, MN

St. Germain’s Glass | Duluth, MN

Heartland Glass | Waite Park, MN

The future of robotics stock investment is a topic gaining traction among investors. With rapid advancements in technology, companies in the robotics sector are poised for growth. According to Dr. Sarah Thompson, a leading expert in robotics investment, "Investing in robotics stock is not just about technology; it's about changing the way we live and work."

The global market for robotics is expanding. Industries like healthcare, manufacturing, and logistics are increasingly adopting robotic solutions. This shift offers a myriad of opportunities for investors. However, the landscape is not without challenges. Many companies in the robotics space still face hurdles in scalability and profitability. Not all robotics startups will succeed, and investors must conduct thorough research.

The current environment for robotics stocks can be uncertain. High volatility in the tech sector can impact these investments. It's vital to remain cautious and reflective when considering robotics stock. Investors should prepare for both potential losses and the exciting possibilities that come with this revolutionary field.

The future of robotics technology is promising, with several exciting trends on the horizon. Automation continues to reshape industries. Robots are increasingly used for manufacturing, logistics, and even healthcare. This growth is driven by advancements in AI and machine learning. Imagine a warehouse where robots handle inventory seamlessly. The efficiency gains are enormous, but there are challenges to address.

Tips: Keep an eye on emerging technologies. Understanding the underlying innovations can help when investing.

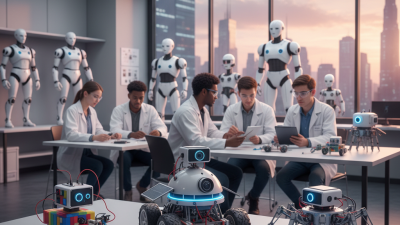

Another trend is human-robot collaboration. Collaborative robots, or cobots, are designed to work alongside humans. These machines enhance productivity while maintaining safety. They can adapt to different tasks and learn from human input. However, integrating these systems is complex and requires thoughtful implementation.

Tips: Research industry leaders. Focus on companies that prioritize innovation and employee training.

The ethical implications of robotics can't be ignored. As robots take over tasks, job displacement is a real concern. Society must adapt to these changes, ensuring a balance between automation and employment opportunities. Investing in robotics means navigating both the potential and the risks.

The robotics stock market is rapidly evolving. Investors are keenly observing key players in the industry. These companies are at the forefront of innovation. They are not only developing robots but also creating intelligent systems that enhance automation.

Many firms are involved, including those focused on manufacturing, healthcare, and logistics. Each sector presents unique opportunities. For instance, some companies are crafting robots for surgical procedures. Others develop autonomous vehicles for warehouse operations. The competition is fierce, and not all players will succeed. The market is volatile and can shift unexpectedly.

Some analysts argue that the future is bright for robotics. However, challenges remain. Many investors are cautious. They ponder the sustainability of profits. The need for constant innovation creates pressure. Will the companies keep up with technological advancements? This ambiguity leaves room for reflection. There’s potential here, but it comes with risk.

| Company Type | Market Capitalization ($ Million) | Annual Revenue Growth (%) | Dividend Yield (%) | P/E Ratio |

|---|---|---|---|---|

| Industrial Robotics | 50,000 | 12.5 | 1.8 | 22 |

| Service Robotics | 30,000 | 15.0 | 2.2 | 25 |

| Medical Robotics | 40,000 | 10.0 | 0.5 | 30 |

| Consumer Robotics | 20,000 | 18.6 | 1.2 | 20 |

Investing in robotics stocks can be intriguing. The sector is rapidly evolving. Many companies focus on automation, AI, and machine learning. These technologies drive efficiency and innovation. However, predicting the best investments isn't always straightforward. Market volatility is common. Investors must be cautious when choosing their stocks.

One effective strategy involves diversifying your portfolio. Don't put all your funds into one company. Instead, consider investing across various robotics sectors. This might include healthcare, manufacturing, and logistics. Each market segment has unique growth potential. Research is essential. Look for trends and emerging technologies. Staying informed can help mitigate risks.

Another aspect to consider is the long-term perspective. Robotics may seem like a trend now. Yet, the underlying technology is here to stay. Short-term fluctuations can be misleading. Relying on patience often pays off. Shareholders may face challenges, such as regulatory issues or competition. But, with a thoughtful strategy, investments in robotics can yield positive results over time.

Investing in robotics stocks presents unique risks and challenges. The first major concern is market volatility. Robotics is a rapidly changing field. Prices can swing wildly. Investors might panic during downturns. This can result in poor decisions. Keeping a cool head is critical.

Another challenge is technological uncertainty. Not all innovations will succeed. Many startups may fail, leaving investors with losses. The investment landscape can become confusing. Companies might pivot away from robotics. This makes it tough to predict future performance. Researching company stability is essential.

Regulatory issues also play a role. Robotics often involves compliance with strict safety standards. Any delays in approvals can affect stock prices. Ethical considerations add complexity. Investors need to be aware of the social impact of robotics. Balancing profit with responsibility is essential for long-term success.

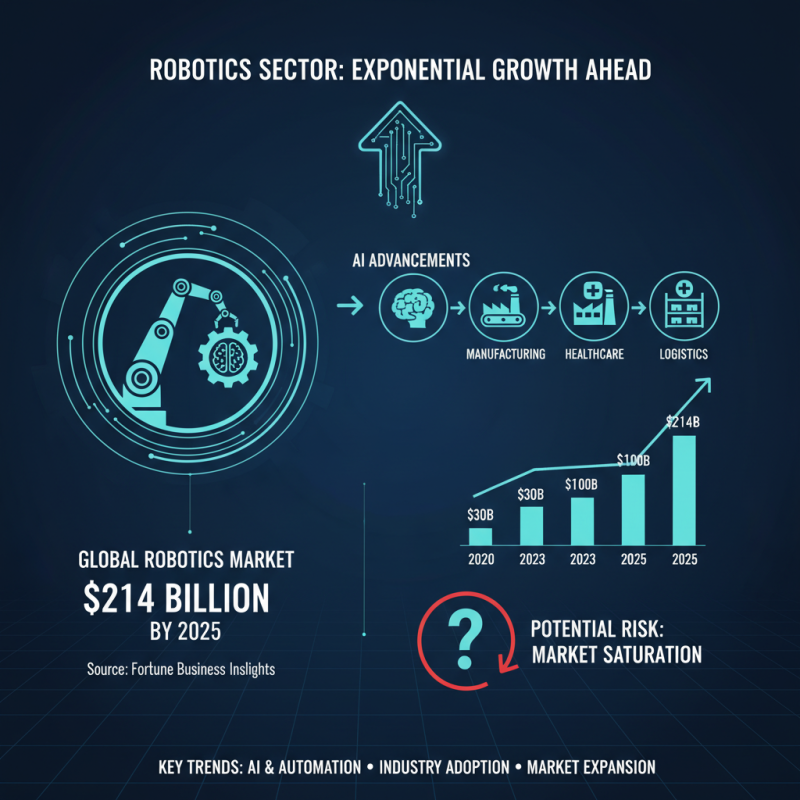

The robotics sector is poised for significant growth. According to a report by Fortune Business Insights, the global robotics market is expected to reach $214 billion by 2025, driven by advancements in AI and automation. This growth trajectory highlights the increasing reliance on robots in various industries. However, the potential for market saturation poses a risk.

Investors should monitor the trends closely. An industry analysis from McKinsey indicates that by 2030, up to 375 million workers may need to transition to different jobs due to automation. This makes it crucial for investors to understand the broader economic context. As companies automate, there will be winners and losers. Some sectors may thrive, while others may struggle.

The challenges in the robotics sector include high development costs and evolving regulations. These factors may hinder growth for some companies. Potential investors should consider these risks seriously. Data from BCG suggests that while the robotics industry holds promise, only a few companies may capture the majority of market share. Understanding which companies can adapt is key to making informed investment decisions.

Taking Custom Design to New Levels

Brin Glass Company | Minneapolis, MN

St. Germain’s Glass | Duluth, MN

Heartland Glass | Waite Park, MN

Fabricator

Inside Sales and Client Support Manager

Glass Handler – 1st Shift