Taking Custom Design to New Levels

PROUD TO BE PART OF THE BRIN FAMILY OF COMPANIES

OTHER BRIN LOCATIONS

Brin Glass Company | Minneapolis, MN

St. Germain’s Glass | Duluth, MN

Heartland Glass | Waite Park, MN

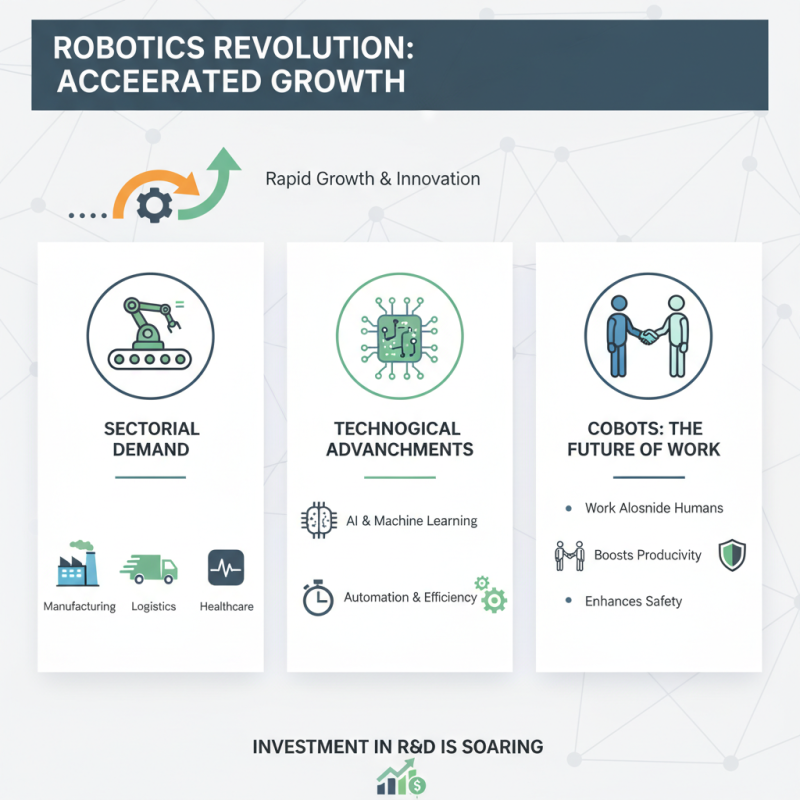

The robotics stock market is poised for significant growth in the coming years. According to a recent report by MarketsandMarkets, the robotics industry is expected to reach $200 billion by 2026. This staggering growth presents ample opportunities for investors who are keen on robotics stock. Industry expert Dr. Jane Thompson, a leading analyst in robotics investments, emphasizes, “The future of robotics will redefine industries and create unmatched investment potential.”

Several companies are leading this transformation. Firms specializing in automation, artificial intelligence, and robotics are emerging as front-runners. For instance, Boston Dynamics continues to innovate with its advanced robotic systems, showcasing the potential of robotics stock. Meanwhile, the rise of collaborative robots, or cobots, in manufacturing indicates a shift towards automation.

Investors should note the volatility in robotics stock. Market fluctuations can affect short-term performance. However, the long-term outlook remains positive. Engaging fully with this sector requires careful analysis and a willingness to adapt. The robotics industry is evolving rapidly, and staying informed is critical for success.

The robotics industry is experiencing rapid growth, driven by advancements in technology and increasing demand across various sectors. Automation is becoming essential in manufacturing, logistics, and healthcare. Companies are investing heavily in research and development to keep pace with this evolving landscape. Collaborative robots, or cobots, play a significant role in enhancing productivity and safety in workplaces. These machines can work alongside humans, making tasks more efficient.

However, challenges remain in this dynamic environment. The skill gap in the workforce hampers the adoption of robotic solutions. Many potential users struggle to integrate these technologies effectively. Moreover, ethical implications and regulatory hurdles often create complications. As robotics becomes more integrated into daily life, companies must navigate these complexities carefully.

Emerging trends demonstrate a shift toward AI-powered robotics. This integration allows for smarter, more adaptive systems. The potential for enhanced decision-making capabilities opens new avenues for growth. Yet, monitoring these developments is crucial. Investors should remain vigilant, as the industry faces both exciting opportunities and potential pitfalls.

Investing in robotics stocks requires understanding key factors that influence their performance. Technological advancements play a huge role. New technologies can drive efficiency and lower costs. As companies innovate, some may succeed while others struggle to keep up. This gap can create volatility in stock prices.

Market demand is another critical factor. Industries are increasingly adopting robotics for automation. This trend can boost stocks but also brings risks. If demand drops, stocks may suffer. Investors should assess industry health continuously.

Tips: Monitor earnings reports regularly. They provide insight into a company's performance. Pay attention to market trends closely. Staying informed can help in making better investment decisions. Remain cautious; the robotics sector is evolving rapidly. Some companies may not adapt successfully to changes. Ensure you research thoroughly before making any moves.

The robotics sector is evolving rapidly. Several companies are leading this transformation. These players are driving innovation across various industries. Their technologies are reshaping how we work and live. They focus on automation, artificial intelligence, and machine learning.

Some companies are making strides in industrial automation. They develop robots that improve manufacturing efficiency. These robots can handle repetitive tasks with precision. However, there are challenges. Implementation costs can be high. Smaller businesses may struggle to adopt advanced technologies.

Other market players focus on service robots. These robots assist in healthcare, hospitality, and logistics. They enhance productivity and reduce human labor. But, safety concerns persist. The integration of robots in everyday life raises questions about ethics and job displacement. Stakeholders must reflect on these issues. Balancing progress and responsibility is crucial for the future of robotics.

The landscape of robotics is rapidly evolving. Emerging technologies are shaping how industries operate. According to a recent report by MarketsandMarkets, the global robotics market is projected to reach $210 billion by 2026. This growth indicates a massive investment potential for savvy investors.

Key trends include automation in manufacturing, medical robotics, and drones. The medical sector is particularly interesting, with robotic surgical systems witnessing an investment surge. These systems promise precision in procedures, offering significant cost savings. In the logistics realm, autonomous delivery systems are reshaping supply chains. They cater to the increasing demand for fast delivery, especially post-pandemic.

Tips: Focus on industries that integrate AI with robotics. Watch for startups that innovate beyond traditional applications. Remember, not all technologies will gain traction. Be selective and do thorough research before investing. Keep an eye out for market fluctuations and critical reviews. This will guide better investment decisions in the dynamic robotics space.

Investing in the robotics sector offers exciting opportunities. However, it comes with significant risks. The market is volatile, influenced by technological advancements and economic shifts. Potential investors need to assess their risk tolerance before diving in.

Regulatory uncertainties can impact companies in this space. Changes in legislation may hinder development or impose extra costs. Additionally, companies relying on cutting-edge technology face the risk of rapid obsolescence. Newer technologies may render existing products less relevant. Investors should keep an eye on these trends.

Tips: Conduct thorough research before investing. Understand the underlying technology. Look at the management team and their track record. Diversify your investments to mitigate risks. Start with small amounts to test your comfort level. Engaging with industry news can provide insights into evolving trends. Stay aware of your investment's performance, but don’t obsess over daily fluctuations.

| Stock Symbol | Predicted Growth (%) | Market Capitalization (Billion $) | Risk Level | Investment Considerations |

|---|---|---|---|---|

| A1B2 | 15% | 8 | Medium | Rapid technological advancements, potential regulatory challenges. |

| C3D4 | 20% | 12 | High | Competitive market, need for continuous innovation. |

| E5F6 | 10% | 6 | Low | Established technology, stable growth prospects. |

| G7H8 | 25% | 15 | High | Emerging technologies, higher volatility. |

| I9J0 | 18% | 9 | Medium | Strong partnerships, focus on R&D. |

Taking Custom Design to New Levels

Brin Glass Company | Minneapolis, MN

St. Germain’s Glass | Duluth, MN

Heartland Glass | Waite Park, MN

Fabricator

Inside Sales and Client Support Manager

Glass Handler – 1st Shift